Samantha Rohn

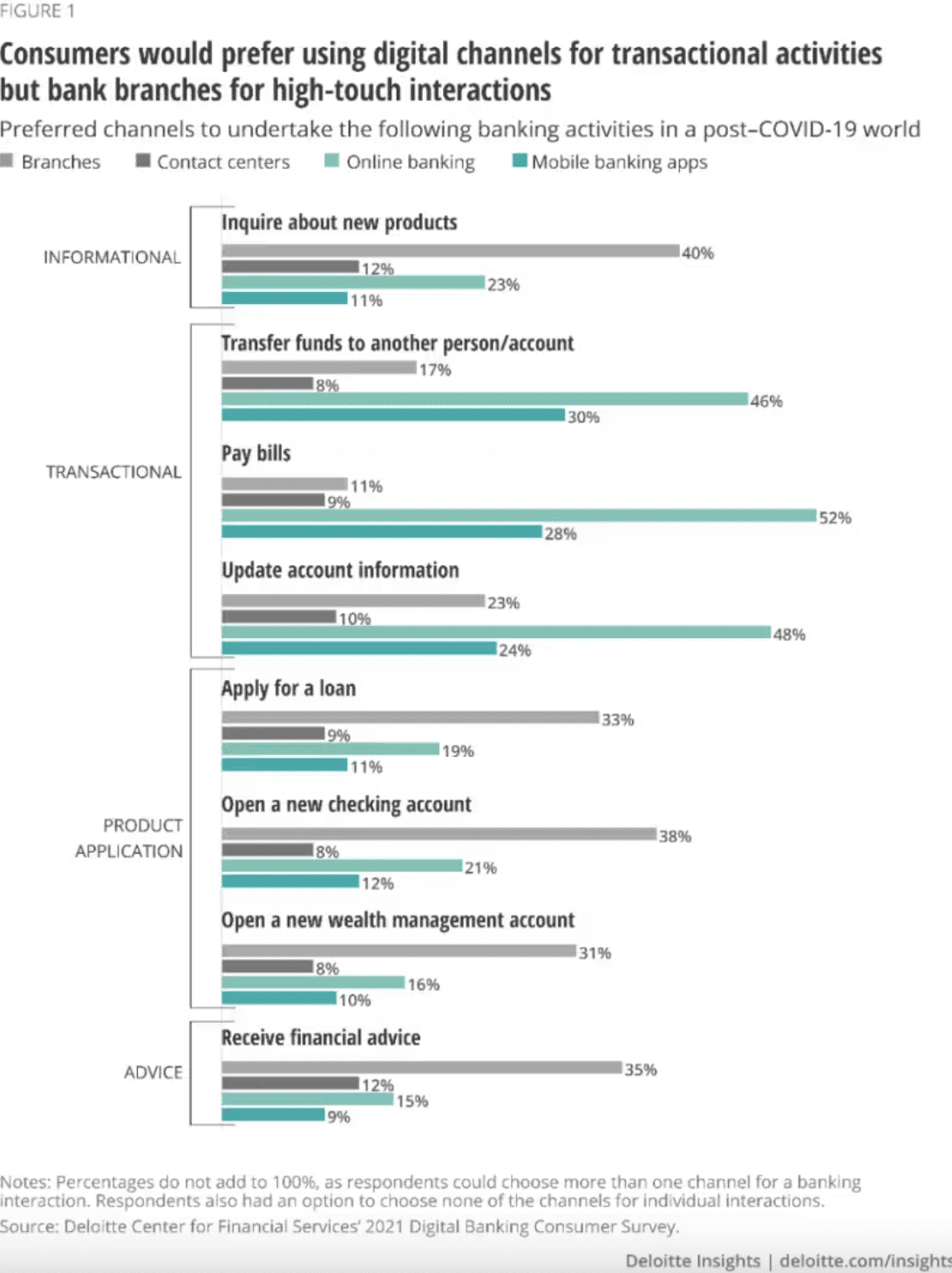

Today, banking customers expect a digital, self-service experience. This doesn’t make bank branches and phone calls obsolete by any means. It actually makes those in-person interactions a lot more effective.

Self-serve options, chatbots, and AI assistants field out simple, repetitive inquiries, which enable bankers to focus on appointments with more hands-on guidance.

More independence, shorter wait times, interactive banking onboarding, mobile banking apps, and fewer burned-out bankers — this is the baseline customer experience we expect from our financial institutions.

Many banks have innovated their offerings above and beyond this baseline. And then there are the new players in the financial services industry that are digitally native. In this complex ecosystem of innovating the old and understanding new, what can we expect from the customer experience?

Customer experience in banking encompasses all interactions individuals have with banking services, both online and in-person.

In addition to their brick-and-mortar locations, banks today are investing heavily in providing customers with a wide variety of online banking products and services.

By having these accessible options for customers, banks are responsible for providing an intuitive and user-friendly customer experience. It’s easier now than ever for customers to assess and identify financial institutions that don’t meet their expectations. A bad customer experience will result in low usage of digital services, a lack of trust in your brand, and customer churn.

Sangeet Paul Choudary, author of ‘Platform Revolution, Platform Scale,’ says that the financial services sector is a prime example of a landscape shifting from a vertical to a horizontal-layered economy.

Financial technology (FinTech) companies are unbundling banking services into an ecosystem of solutions that customers can choose from based on their unique needs. “Multiple competing firms can take up positions that were previously occupied by a single financial services firm, thus driving down margins and expanding consumer choice,” Choudary writes.

The digitization of the customer experience plays a significant role in driving this transformation. With more modern solutions to choose from, customers can pick and choose solutions that meet their expectations. You won’t make the cut if your app doesn’t feel user-friendly. This means having characteristics like:

Digital solutions will continue to capture larger shares of the market. Financial institutions will learn from their shortcomings and iterate on existing offerings to bring us more robust and mature products. Technology will also become easier to use and more accessible across all demographic groups, unlocking more innovative use cases and a bigger emphasis on effective data management.

Here are some trends to expect:

Personalization happens when data from different sources come together and form a coherent picture of a customer’s banking priorities and preferences. This data is harnessed across a variety of channels, from surveys to website transactions and even in the way users interact with applications and online interfaces. AI accelerates data processing by removing manual work and finding context from fragmented data. For example, Whatfix’s digital adoption platform leverages AI to provide an additional layer of personalization to the user experience through auto-complete, elaborate, and summarize text features optimized for each user’s documentation and processes.

Banks will feel pressure from younger customers to invest heavily in the online customer experience to avoid losing them to new innovative competitors. A survey by Deloitte found that 29% of millennials would be likely to open bank accounts with digital-only banks. The same trend was seen for underbanked and at-risk consumers. Traditional institutions will try to keep up by incorporating popular digital features into their banking experience, like peer-to-peer payments and robo-advisors.

Block technology is the new kid on the block, but it’s making a big impact in amping up security and efficiency. It reduces dependencies on third parties to verify transactions and is instead maintained by a large volume of supercomputers. The decentralization of accountability across a public network means hackers don’t know who and what to target. More importantly, blockchains leave an audit trail with information that cannot be altered once it’s been uploaded onto the network.

Banks play a big role in an individual’s life, so a bank’s brand and reputation will become a point of scrutiny in today’s more socially conscious customers. Financial institutions must identify and execute programs that focus on one or more environmental, social, and governance (ESG) factors. For example, the online-only neobank, Aspiration, pledged never to use or invest its funds in the fossil fuel industry. Its customers also know that each of their transactions contributes to a reforestation initiative.

The bar for customer service is high. Banking customers will compare the platform’s responsiveness and quality of support to every other digital experience they have. If they can get real-time service and recommendations from retail stores, travel services, and healthcare providers, then the same standard applies to their banking experience too. In fact, immediate service is the expectation for 72% of consumers today.

In 2021, banks and financial institutions in the US processed over $1 billion in payments that were likely made to deal with ransomware attacks. With customers becoming more comfortable moving their banking activities online, concerns have rightfully been raised about data privacy and security.

There are multiple measures that banks put in place to ensure personal data isn’t accessible to unwanted parties, including:

There are many ways to define a great customer experience. Convenience and ease of use are imperative for customers to accept and adopt digital banking channels. But on top of that, banking activities call for an additional layer of security and customer support, given the sensitivity of the data that’s being shared.

What exactly do financial institutions need to prioritize to boost customer satisfaction? Let’s take a look at some examples of good customer experience in banking.

This year, 56% of enterprises in the financial services industry saw an increase in the volume of customer support tickets. This trend indicates that there may be a gap in what customers get from their product or service experience and what they need to be successful. The good news is that these tickets are your best source of information to analyze customer sentiment and identify customer experience challenges.

Easy navigation, clear instructions, and good design make for a smooth user journey. Frustration piles up if customers feel confused and uncertain about next steps in your app. Banks use digital adoption platforms (DAP) like Whatfix to implement modern and interactive in-app guidance to nudge customers along important processes and actions.

Banks use software-driven infrastructure to enable personalization by combining customer service data with data from functions like sales, marketing, and product. This unlocks deeper segmentation capabilities across different kinds of banking services and offerings. Personalization makes banking assessments and product recommendations more accurate and efficient for both online and in-person interactions.

The game-changing difference between physical and digital banking channels is time. Without the hassle of making a commute and avoiding scheduling conflicts, online banking gives customers the freedom to get things done faster. Laggy and poorly designed platforms take away from the speed and reliability of digital channels. Banks must always be aware of customer frustration signals and continuously optimize the user experience.

Trust is the basis of a successful customer experience in the banking space. More than half of consumers feel comfortable discussing personal matters via mobile messaging only because they have a high degree of trust in their banks. Investing in customer experiences, especially digitally, must be coupled with a strategy for understanding your customer’s privacy needs, communicating your plan of action, and reassuring them throughout the relationship.

There are strict regulations and privacy policies that banks have to implement to guarantee the protection of customer data. These involve implementing safeguards for handling customer information according to local or regional standards, implementing industry-approved data anonymization techniques, storing data in secure environments, and deploying strong operational processes for monitoring networks to identify and respond to security threats.

Customers rely on their banks to be a source of truth for their financial information, regardless of whether they interact with services in-person, on a web browser, or in a mobile app. If you want to double down on your omnichannel customer experience, prioritize having new or edited data automatically logged and reflected across all your platforms. This ensures your customers make accurate decisions every step of the way and avoid unnecessary errors stemming from misinformation.

A 2024 survey found that 66% of customers don’t want their customer support interactions to interrupt their actions on the platform. Banks use digital adoption platforms like Whatfix to bridge the gap between on-demand services and undisruptive support. Interactive in-app elements like tooltips and self-help knowledge bases give customers a quick and easy way to refer to or pull resources during a time of need without having to jump in and out of different tabs and chat windows.

Artificial intelligence has opened the doors to huge customer experience improvements in the banking space. One core area of focus is using this technology to equip digital banking channels with features that can predict customer behavior and nudge them toward a recommended course of action. For instance, bank apps can send customers automated alerts when payment due dates are coming up or if suspicious behavior is seen on the account.

Many banks embrace the principle of open banking, which enables integrations with third-party services so customers can access a broader range of financial services that may not fall under the realm of their bank — think investment tools, personal budgeting apps, or digital currency platforms that allow customers to view or transfer money in their bank accounts.

Customers are always on the lookout for financial solutions that can deliver their ideal customer experience qualifications. For some, third-party integrations are a dealbreaker, while others may prioritize AI-assisted features and real-time availability. Banks that aren’t proactive about understanding and meeting customer needs will miss out on the following benefits.

When customers see you consistently upgrading and innovating your services, they don’t feel like they’re getting left behind. With so many options for your customers to choose from, make it a point to get feedback regularly so you can focus on building experiences that will retain customers.

With less friction in the banking experience, customers feel more confident in their financial decision-making and are more likely to commit to banking products and services. For example, the shift to digital channels accounted for 61% of US Bank’s loan sales in 2021.

A value-driven customer experience is also a powerful marketing tool that builds credibility for your brand. For example, Citibank invested in creating a fun and enjoyable customer experience for its credit card holders through the Citi Entertainment Program. These customers now have more reason to champion Citibank through increased usage or engaging in word-of-mouth marketing.

Research by Deloitte discovered that many younger customers are less satisfied with their banks and are more likely to switch to a competitor. Prioritize audience research and consistent optimization to ensure your customer experience is up to par with trends in the market. Failure to do so can be taken as a sign of an outdated institution with less to offer than competitors.

When customers are held back by technical difficulties and delayed customer service, support tickets, and queries pile up. You can avoid this by equipping your customer experience with interactive and personalized in-app support like self-help centers, guided walkthroughs, and smart tips.

Qualities of a trustworthy bank include many actions that derive from a great customer experience — like responsiveness, multi-touch engagement to understand customer needs, providing objective financial advice, and being upfront about data privacy standards.

Banking experiences — especially the frustrating ones — are a common topic of discussion in families, friend groups, and workspaces. A strong customer experience is one of the best ways to make an impact and develop trust via a network effect. The last thing you want to be is the horror story that gets brought up at dinner parties.

Satisfied customers are the ones banks can rely on to build long-term relationships, increase product adoption, and share the word with others. Regardless of how good a financial product or service may be, customers will grow impatient and frustrated if they’re greeted with a poor customer experience. First impressions matter.

Providing an easy-to-use centralized hub for financial activities and resources makes it easier for customers to explore new banking capabilities and implement new financial plans or routines on top of what they already have.

Technical difficulties, slow user interfaces, and high levels of user frustration bogs banks down with maintenance work that takes away from core deliverables. Investing in the customer experience allows banks to optimize processes to meet KPIs right from the get-go instead of waiting for something to break.

Building an ideal customer experience is a multifaceted project. Organizations will have to consider the entire customer and employee journey — from implementing new technology to changing mindsets and maintaining the quality of new systems.

Let’s explore the challenges financial institutions must avoid when transforming the customer experience.

Many organizations in the financial sector find it difficult to roll out new technologies efficiently due to legacy infrastructure and a large number of employees and customers who need training. More complexities and longer wait times are also introduced when these technologies are customized to meet the needs of each bank’s offerings and business models.

Given the speed of digital evolution, banks run the risk of having to invest in and rehaul their customer experiences more frequently. On top of keeping customers satisfied with existing services and products, banks need to dedicate their time to monitoring market trends and identifying ways to integrate innovation into their long-term strategy.

As customers move their banking experiences online, the pressure is on for banks to invest in comprehensive security measures that protect sensitive customer data. Financial institutions will need to strengthen their processes for identifying and resolving the impacts of risky activity like identity theft, phishing, and data breaches.

Building a new customer experience starts internally. Banks can build a customer-first mindset by empowering employees with training opportunities and resources that educate them on valuable people skills. Show employees they’re part of a shared goal that can provide immense value to their personal and professional growth.

Financial institutions serve customers across a range of age groups with different digital proficiency levels. All banking channels should be equipped with intuitive user interfaces that can be customized to meet the needs of each customer demographic. With Whatfix’s product analytics, you can track user behavior and segment those interactions by age group to better understand what each group struggles with the most.

Like most industries, banks may feel less inclined to prioritize the customer experience due to resources being spread thin across each core business function. Finding tools that can automate and streamline processes like customer support, user behavior analysis, and user experience optimizations will save time and reduce overhead costs in the long term.

Although multichannel services are the norm, it makes customer service operations a much bigger undertaking. Implementing these channels is only half the battle. Banks will also have to ensure that both back-end and front-end teams have the tools and resources to keep these systems integrated and in sync with up-to-date data.

The data shared by customers across all banking channels needs to be both up-to-date and, most importantly, consistent. Banks put customers at risk by having inconsistent data because it can lead to poor decisions and financial planning. Organizations need to implement a robust data infrastructure, a data-driven team culture, easy-to-understand processes, and standard operating procedures to keep data consistency in check.

Legacy systems can be difficult to uproot because they’re so woven into existing business processes. Organizations will benefit from having technology systems that can be integrated into existing systems without eating up a significant chunk of developer time. Technologies like digital adoption platforms are one example of how banks can elevate outdated user interfaces into customizable, modern customer experiences without taking away engineering time.

Implementing an agile digital infrastructure to power your customer experience is critical because it allows continuous iterations and easy maintenance. With Whatfix’s digital adoption platform, you can turn your user interface into a customizable canvas for walking customers through important in-app actions.

Use interactive walkthroughs, pop-ups, step-by-step guidance, task lists, and more to provide users with real-time assistance right within your digital or mobile banking app. That means no jumping from one tab to another to refer to support content and waiting for someone else to help.

Whatfix will help improve your end-user’s banking customer experience by:

Customize your user journeys without any code and without compromising the sophistication of your platform. Get started with Whatfix today to improve customer experience and increase customer retention.

Thank you for subscribing!