13 Best Digital Banking Platforms in 2024

- Published:

- Updated: May 29, 2024

If you’re one of the 78% of Americans who opt to do their banking digitally, you might be managing your financial processes with one or even several different applications.

Leading financial institutions are already accommodating this shift in consumer preferences— a 2022 survey found that more than half of consumers do their banking on their bank or credit union’s mobile app.

But these digital experiences aren’t easy to implement without the proper infrastructure for collecting data, integrating with other solutions, communicating information securely, and detecting fraud.

Many financial institutions use a digital banking platform to prevent risk and delays by allowing employees and end-users to seamlessly transition to online services across different channels and market segments.

So how do you select a digital banking platform that fits your needs? This article explains the features to look for and tools to consider.

What are the best digital banking platforms in 2024?

- nCino

- Finflux

- Alkami

- Q2

- NETinfo

- BankPoint

- Nubank

- TCS BaNCS Digital

- ServiceNow Financial Services Operations

- Finacle Core Banking Solution

- Monzo

- FIS Core Banking

- FNZ

What Is a Digital Banking Platform?

Banks, credit unions, and financial institutions use digital banking platforms to give customers online channels for conducting traditional banking processes and activities. With the right solution partner, most banking services can be digitized.

Some digital banking platforms focus on loan and wealth management, while others specifically target day-to-day banking activities like fund transfers, managing savings and checking accounts, and monitoring transactions.

Software platforms can also introduce additional functionalities to your bank’s core systems through API integrations, automation, and no-to-low-code builders for pages and features.

These platforms are used by financial institutions of all sizes, from small to medium-sized banks looking to onboard more customers, to large international banks condensing manual workloads into event-based workflows.

Features of Digital Banking Platforms

A digital banking platform offers various end-to-end features. Depending on your use case, you can select the financial products and services that make the most sense for your clients.

Some platforms even give banks complete flexibility to build targeted offerings using API integrations with other financial technology partners. This empowers banks to enhance their online and mobile apps with features beyond the platform’s core offerings.

Here are some features you’ll see in digital banking platforms:

- Open and manage financial accounts

- Financial management dashboards

- Online applications and reviews

- Security and fraud protection

- Money transfers

- Bill payments

- Budgeting tools

- Alerts and push notifications

- Third-party integrations

- Customizable branding

Benefits of Digital Banking Platform

Digital banking platforms offer many benefits due to their comprehensive features. But digital transformation in financial services is primarily driven by the need to improve operating efficiency, boost revenue, and increase customer retention.

Here are a few benefits provided by a digital banking platform:

1. Provide 24/7 service

You can reduce dependency on customer service representatives for simple processes that don’t require complex consultations, like opening accounts, keeping track of loans, or submitting applications and payments. Having online and mobile channels gives your customers the freedom to monitor their financial health and act on important decisions anytime, anywhere.

2. Accelerate client onboarding

A web or mobile app helps you provide self-service customer onboarding. This means your customers won’t need to schedule in-person appointments, fill out heavy paperwork, or have longer wait times while corresponding with bank branch representatives.

Instead, you can use interactive walkthroughs, smart tasklists, customizable workflows, and automated routing to conduct faster processes entirely online. This helps you onboard more customers and process client information a lot faster.

3. Boost client engagement

Digital platforms allow end customers to proactively manage their finances and stay up to date on important reminders and milestones. Instead of forcing customers to visit a nearby bank branch or sort through paperwork, you can reduce customer stress and ambiguity by giving them constant access to their most vital financial information.

When customers feel more confident in their management abilities, they’re more likely to engage with you about future plans. Financial institutions can also prevent customers from becoming unresponsive by using push notifications and real-time event-based triggers.

4. Deliver a modern user experience

Legacy bank systems have a reputation for being slow and unresponsive. Many customers expect intuitive interfaces and often see them in their smartphones, social media apps, and even business apps for communicating and project management. Rolling out a modern user experience of the same caliber is a big task if you’re building it from scratch. A digital banking platform offers the same value with pre-built elements you can personalize based on your needs.

5. Enhanced security

There’s a common misconception that digital banking is less secure than conducting processes at a physical bank.

Matthew Williamson, global vice president of financial services at Mobiquity, tells Forbes that digital payments and e-wallets provide more security than physical cards. An excellent digital banking platform provides many security features, allowing you to take more security precautions than you typically would when accessing financial information at a bank. These precautions include biometric identification- like facial recognition, voice recognition, and fingerprint recognition- as well as multi-factor authentication and immediate alerts when logins are attempted in unfamiliar places.

13 Best Digital Banking Platforms in 2024

In this list, we’ll share 13 popular digital banking platforms that financial institutions use to deliver value to their customers.

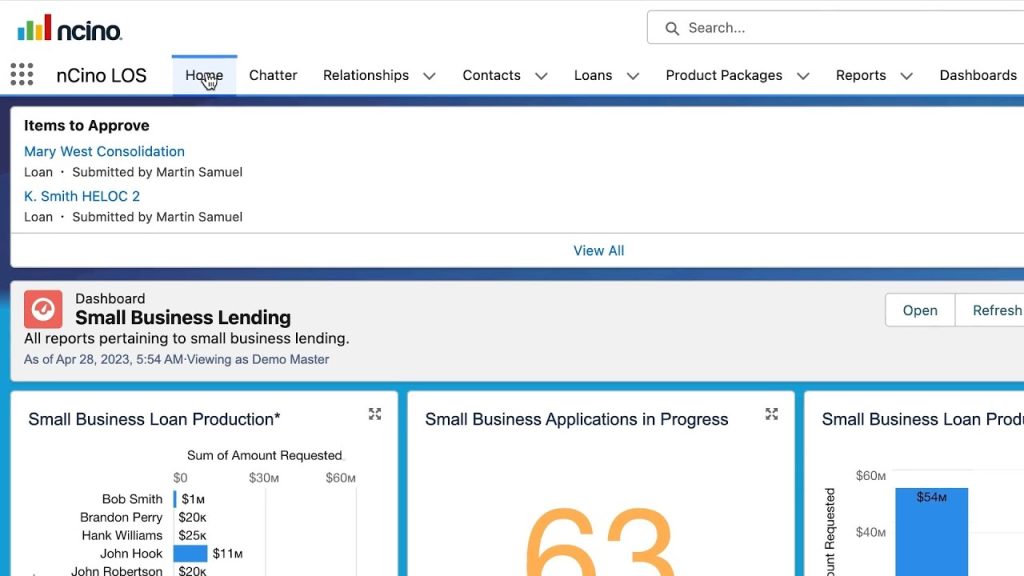

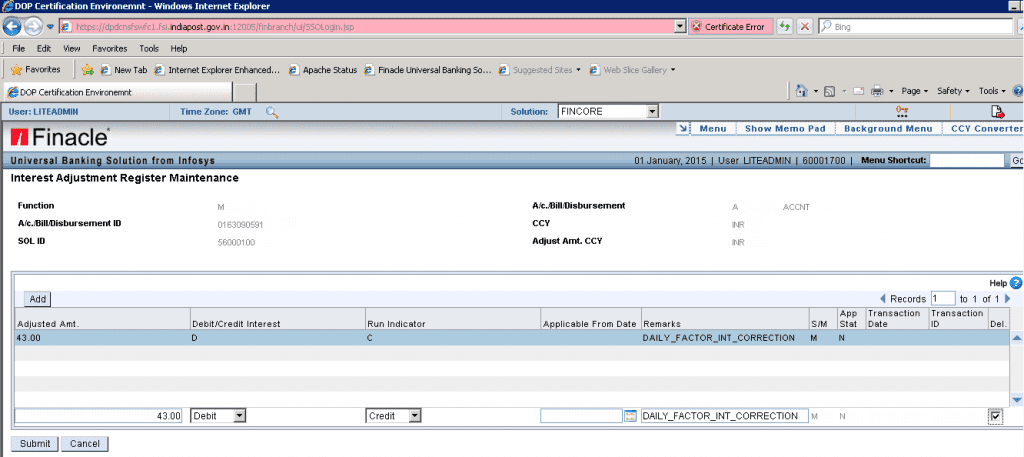

1. nCino

- G2 Rating: 4.4 out of 5 stars

- Pricing: Contact for pricing details

nCino is a robust platform that financial institutions use to enhance digital customer interactions, specifically in loan and deposit activities. It serves as a comprehensive solution streamlining customer relationship management, content handling, workflows, and reporting. Designed to cater to various banking needs, it supports asset finance, leasing, customer engagement, treasury management, and portfolio analysis. This end-to-end system is versatile enough for small and commercial businesses, helping accelerate the loan closing process and improve customer satisfaction.

Key features:

- Enables digital deposit account opening to streamline customer onboarding.

- Offers a comprehensive loan origination system to facilitate quicker loan processing.

- Includes a customer portal for enhanced user engagement and self-service.

- Supports online applications, allowing for remote and paperless banking operations.

- Allows customizable branding to maintain a bank’s identity across digital platforms.

- Utilized by over 1,700 financial institutions worldwide, demonstrating its reliability and scale.

- Trusted by major clients such as Navy Federal Credit Union, SunTrust Banks, and ConnectOne Bank for their digital transformations.

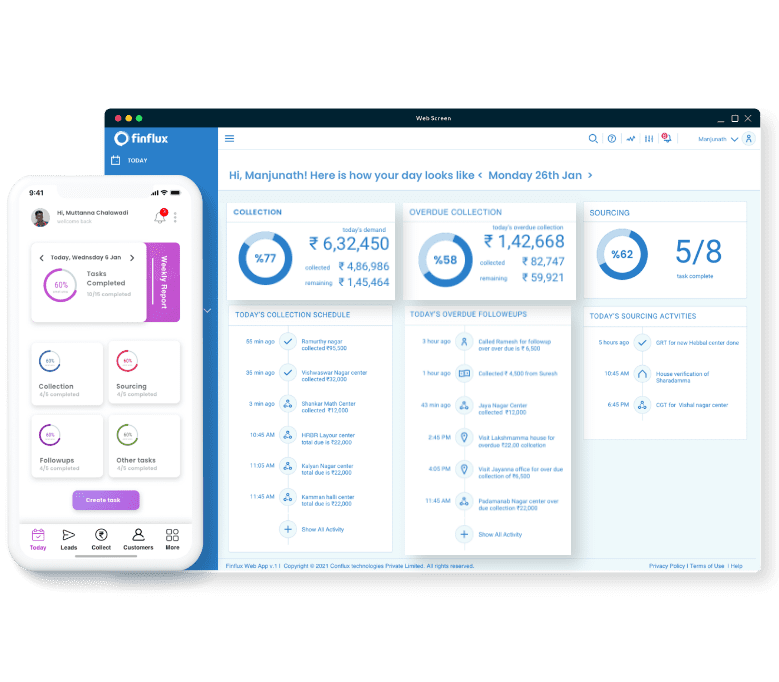

2. Finflux

- G2 Rating: 4.6 out of 5 stars

- Pricing: Pay as you go/user/year

Finflux is a dynamic cloud-based platform designed for lending institutions, serving over four million borrowers with a comprehensive suite of services. The system manages many functions, including loan management, origination, debt collection, and liability management. Its robust API integrations facilitate efficient data analysis from diverse sources and enable the customization of digital experiences for various loan types. Notably, Finflux is enhanced by an intuitive mobile application that consolidates all necessary loan information into a single dashboard for borrowers,

Key features:

- Supports flexible loan products tailored to diverse lending needs.

- Provides a reporting dashboard for real-time financial tracking and analytics.

- Offers extensive API integrations for seamless data synchronization and functionality expansion.

- Automates workflows and events to streamline operations and reduce manual tasks.

- Sends notifications and alerts to keep both staff and borrowers updated on critical information.

- Features a borrower dashboard that presents comprehensive loan details and status updates.

- Mobile app allows borrowers to upload documents, view loan pipelines, and receive payment reminders directly from their smartphones.

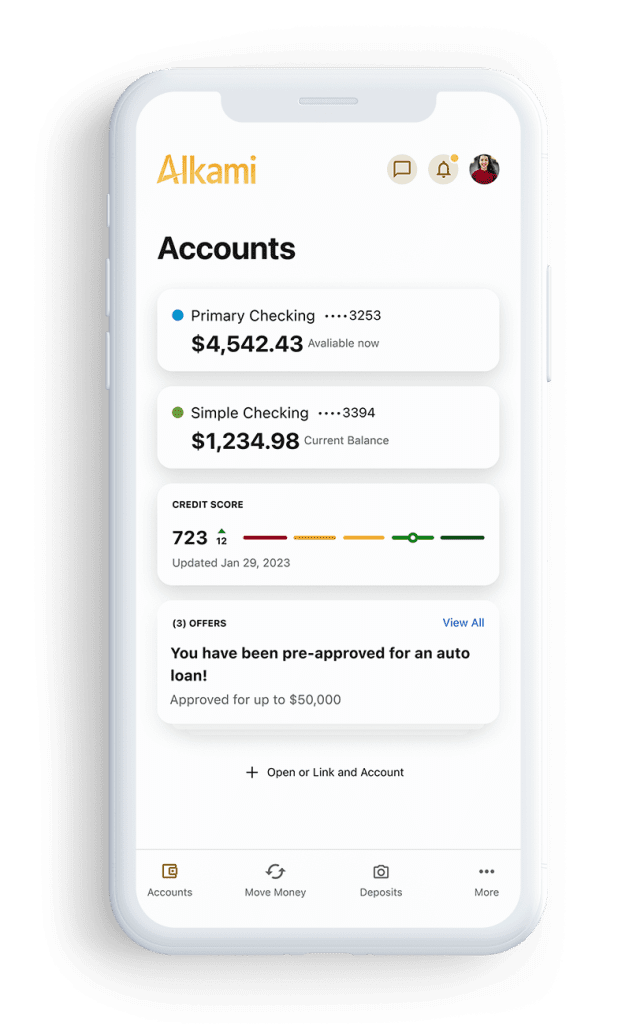

3. Alkami

- G2 Rating: 4.3 out of 5 stars

- Pricing: Contact for pricing details

Alkami Platform is an advanced digital banking solution designed to empower banks and credit unions to acquire and maintain relationships with both retail and business customers. This platform is notable for its deployment across large credit unions, such as the Idaho Central Credit Union, which boasts over 400,000 members. Alkami enhances user engagement through an intuitive mobile app that simplifies managing payments, opening accounts, and virtual communication with customer support.

Key features:

- Offers comprehensive account management for a streamlined banking experience.

- Facilitates loan applications through an easy-to-use digital interface.

- Includes a financial health tracker to help users monitor and improve their financial status.

- Provides robust credit card management tools.

- Ensures high security and fraud protection to safeguard user data and transactions.

- Automates billing processes to increase operational efficiency.

- Supports over 200 integrations, offering vast customization options through SDKs and certified technology partners.

- Enables creation of customized application dashboards tailored to users’ financial needs and preferences.

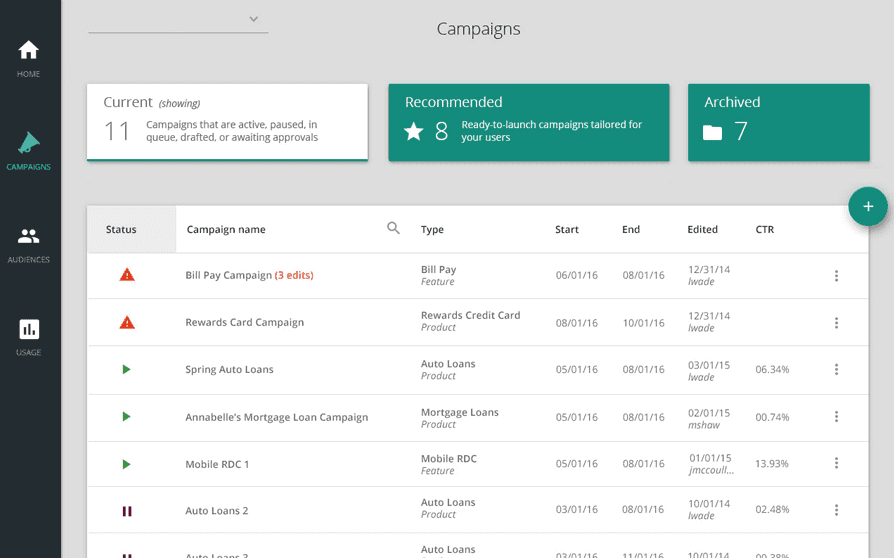

4. Q2

- G2 Rating: 4.5 out of 5 stars

- Pricing: Contact for pricing details

Q2 offers a modern and streamlined digital banking experience, focusing on usability for digital banking, lending, and account onboarding. Known for its clean interface and feature-rich environment, Q2 is praised for making it easy for users to navigate financial products and discover services that best fit their needs. The platform is particularly favored by institutions like the Stanford Federal Credit Union (SFCU), which caters to a tech-savvy audience, including Stanford University affiliates and Silicon Valley employees. SFCU leverages Q2 to gamify its member rewards dashboard, enhancing user engagement through innovative digital solutions.

Key features:

- Features a customizable user portal that can be tailored to specific customer needs.

- Includes no-code app workflows, enabling rapid deployment and easy updates.

- Supports streamlined account opening processes.

- Facilitates straightforward loan application services.

- Provides multi-channel customer service for comprehensive support.

- Employs robust security and fraud detection mechanisms to protect user data.

- Allows for account consolidation to manage multiple accounts seamlessly.

- Utilizes behavioral analytics to tailor product offerings and improve relevance.

- Empowers employees with data-driven insights to enhance sales and customer support.

5. NETinfo

- G2 Rating: 5 out of 5 stars

- Pricing: Contact for pricing details

NETinfo is engineered to provide a seamless digital banking experience across various channels, including desktop browsers, mobile apps, digital wallets, ATMs, and smartwatches. It supports a global clientele, including prominent institutions like Eurobank Cyprus and Euro Pacific Bank. This versatile platform enables banks and financial services providers to deploy cloud-based solutions encompassing banking, retail, investment, and wealth management services.

Key features:

- Comprehensive account management allows for efficient handling of banking operations.

- Enables fund transfers across accounts and financial institutions.

- Utilizes widget-based dashboards for personalized user interfaces.

- Offers a multi-lingual online banking system to cater to a diverse customer base.

- Features flexible page builders that facilitate the easy creation of custom banking pages.

- Sends push notifications to keep users informed about account activity and offers.

- Includes financial management tools to help users track and plan their finances.

- Allows institutions to swiftly design and optimize new products for specific channels and user groups.

- Supports no-code layout builders and pre-built workflows, enabling banks to easily publish new pages and features.

6. BankPoint

- G2 Rating: 4.8 out of 5 stars

- Pricing: Contact for pricing details

BankPoint is an integrated bank management system designed to centralize data for a comprehensive analysis of customer and loan relationships. It simplifies the loan management process by offering end-to-end services on a single platform, eliminating the need for fragmented apps and services. This system is particularly beneficial for banks that aim to streamline their operations and enhance efficiency in managing loan pipelines, even in a paperless environment. Notable users like Nexbank and Plains Capital Bank have adopted BankPoint to enhance their core banking systems, allowing for quicker processing and analysis of information.

Key features:

- Offers a flexible pipeline dashboard and stages to manage loan processes effectively.

- Supports document upload capabilities to streamline document management.

- Provides customizable branding to maintain bank identity across interfaces.

- Sends automatic reminders for document collection to ensure timely submissions.

- Includes loan approval workflows to facilitate efficient decision-making.

- Integrates with third-party applications to expand functionality and versatility.

- Features robust checklists, virus scanners, and review workflows to automate and synchronize document collection and covenant reviews.

7. Nubank

- G2 Rating: 4.4 out of 5 stars

- Pricing: Contact for pricing details

Nubank is a pioneering digital banking platform renowned for its user-friendly design and innovative financial solutions. Aimed at transforming the traditional banking landscape, Nubank leverages technology to simplify financial services and improve accessibility for its users. It is particularly popular in Latin America, where it has disrupted the financial sector by offering straightforward, low-fee banking options. The platform is designed to cater to a modern, tech-savvy audience, providing a range of services from savings accounts to personal loans, all managed through a mobile app.

Key features:

- Provides a streamlined mobile banking experience, making financial management accessible anywhere.

- Offers a no-fee structure on basic banking services to reduce costs for users.

- Includes instant payment and money transfer services to facilitate easy transactions.

- Features a credit card management system that integrates directly with the mobile app.

- Employs advanced security measures to protect user data and transactions.

- Utilizes analytics to offer personalized financial advice and product offerings.

- Supports customer service through a digital-first approach, ensuring fast and efficient resolutions.

8. TCS BaNCS Digital

- G2 Rating: 4.6 out of 5 stars

- Pricing: Contact for pricing details

TCS BaNCS Digital is a comprehensive digital banking solution developed by Tata Consultancy Services, designed to cater to the evolving needs of modern banks, financial institutions, and their customers. It enables entities to offer enriched digital experiences that are both secure and scalable across various banking and financial sectors. TCS BaNCS Digital supports many banking activities, including retail banking, corporate banking, wealth management, and compliance management, all integrated into a seamless digital environment.

Key features:

- Provides an omnichannel experience, allowing customers to interact with their bank from any device.

- Supports real-time processing for transactions and banking operations to ensure efficiency.

- Offers robust compliance management tools to help institutions adhere to regulatory standards.

- Integrates advanced analytics to enable personalized banking services and product recommendations.

- Facilitates wealth and asset management services with portfolio analysis and investment tracking tools.

- Enhances customer engagement through customized marketing and communication tools.

- Employs high-level security protocols to safeguard financial data and transactions.

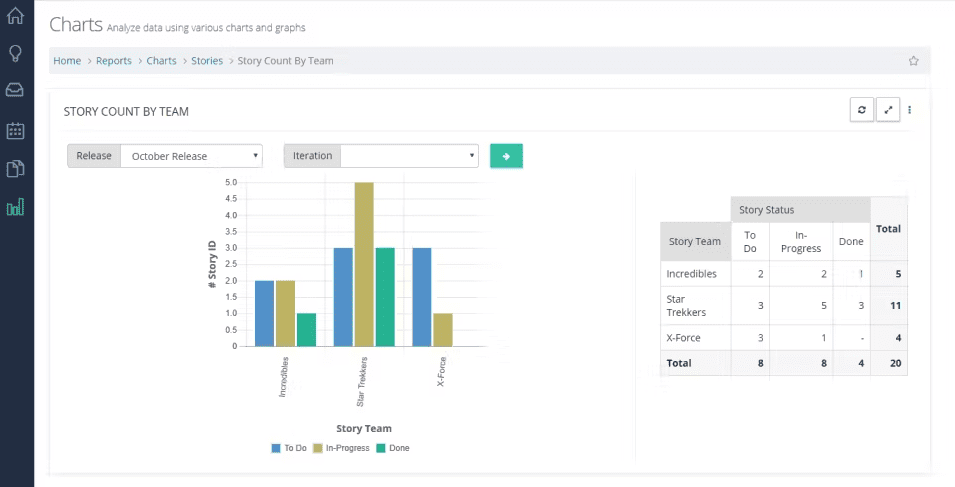

9. ServiceNow Financial Services Operations

- G2 Rating: 4.5 out of 5 stars

- Pricing: Contact for pricing details

ServiceNow Financial Services Operations is an integrated platform designed to modernize and streamline the operations of financial institutions. This solution focuses on enhancing the efficiency and transparency of banking services, leveraging automation to reduce manual processes and improve overall customer experiences. ServiceNow’s platform is ideal for banks, insurance companies, and investment firms looking to innovate their operational models and deliver superior service management across all customer touchpoints.

Key features:

- Automates key financial operations, including risk management and compliance processes.

- Provides a unified platform for managing customer interactions and service requests.

- Offers customizable workflows to optimize various financial processes.

- Integrates seamlessly with existing financial systems for enhanced data consistency.

- Supports real-time analytics to monitor performance and customer satisfaction.

- Enhances security protocols to protect sensitive financial information.

- Facilitates collaboration across departments to improve service delivery and response times.

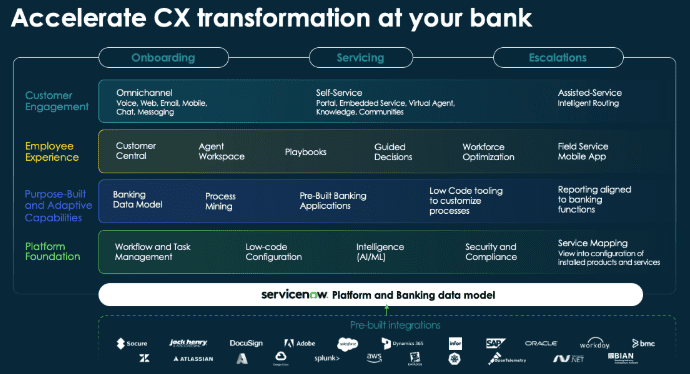

10. Finacle Core Banking Solution

- G2 Rating: 4.3 out of 5 stars

- Pricing: Contact for pricing details

Finacle Core Banking Solution, developed by Infosys, is a robust banking platform designed to address the needs of banks operating in a dynamic market environment. This solution provides a comprehensive suite of functionalities that enable banks to deliver a superior customer experience while ensuring agility, cost efficiency, and effective operations management across global financial networks. Finacle is well-suited for retail, corporate, and universal banking operations, supporting millions of transactions daily with high reliability and scalability.

Key features:

- Offers a 24/7 processing environment to support continuous banking operations.

- Provides a wide range of banking services, including deposits, loans, payments, and wealth management.

- Features an advanced real-time analytics engine to drive personalized banking experiences.

- Supports multi-currency transactions and operations across international borders.

- Enables digital transformation with API banking, blockchain integration, and advanced digital payment solutions.

- Employs robust security measures to ensure data integrity and compliance with global standards.

- Facilitates seamless integration with third-party services and legacy systems to enhance operational efficiency.

11. Monzo

- G2 Rating: 4.3 out of 5 stars

- Pricing: Contact for pricing details

Monzo is a digital-only bank based in the UK, known for its innovative approach to banking and commitment to transparency and customer service. Designed to cater to the modern consumer’s needs, Monzo offers a user-friendly interface and a variety of banking services managed entirely through a mobile app. Its focus on technology and customer experience makes it a favorite among tech-savvy users, particularly those who prefer managing their finances on the go.

Key features:

- Provides real-time notifications for all transactions to keep users informed and in control.

- Features “Pots” for budgeting and savings goals, allowing users to set aside money within separate mini-accounts.

- Offers fee-free spending abroad, including ATM withdrawals, making it ideal for travelers.

- Includes a feature-rich mobile app that integrates various financial tools and services.

- Supports seamless peer-to-peer payments and money requests directly through the app.

- Utilizes stringent security protocols to protect user data and prevent unauthorized access.

- Provides extensive customer support through in-app chat, offering quick and efficient problem resolution.

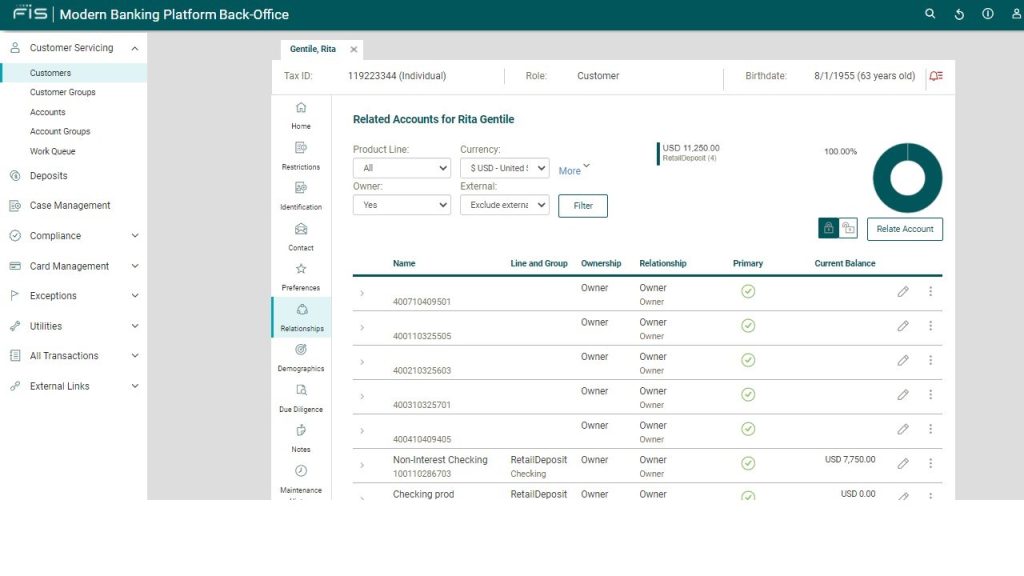

12. FIS Core Banking

- G2 Rating: 4.2 out of 5 stars

- Pricing: Contact for pricing details

FIS Core Banking is a comprehensive banking platform designed to support financial institutions in delivering extensive banking services efficiently and securely. This solution caters to the diverse needs of retail, corporate, and investment banking sectors, enabling banks to adapt to changing market conditions and customer demands. FIS Core Banking combines robust functionality with advanced technology to facilitate seamless transactions, improve customer engagement, and enhance operational efficiencies.

Key features:

- Supports a full range of banking operations, including account management, loan servicing, and funds transfer.

- Offers scalable architecture to handle high volumes of transactions and expand as business needs grow.

- Integrates with advanced analytics tools to provide insights into customer behavior and improve service offerings.

- Features comprehensive risk management and compliance modules to ensure adherence to regulatory standards.

- Provides a modular design that allows financial institutions to customize and upgrade services as needed.

- Enables omnichannel banking, offering a consistent experience across all digital and physical touchpoints.

- Employs state-of-the-art security measures to safeguard customer information and prevent fraud.

13. FNZ

- G2 Rating: 4.3 out of 5 stars

- Pricing: Contact for pricing details

FNZ, formerly known as Appway, is a leading financial technology company that provides a comprehensive suite of solutions for wealth management, banking, and insurance sectors. FNZ focuses on streamlining operations, enhancing customer engagement, and facilitating regulatory compliance through digital transformation. This platform is renowned for enabling financial institutions to manage assets effectively and deliver personalized investment solutions at scale.

Key features:

- Offers advanced wealth and asset management tools to optimize investment strategies and client portfolios.

- Facilitates seamless onboarding of new clients with digital workflows that reduce paperwork and processing time.

- Provides regulatory compliance solutions that are up-to-date with global financial regulations.

- Features a client management module that enhances interaction and communication with customers.

- Supports multi-channel delivery, allowing customers to access services via mobile, web, or in-person consultations.

- Integrates with various financial systems and third-party services to provide a unified customer experience.

- Employs robust security protocols to protect sensitive financial information and ensure data integrity.

Selecting the right digital banking platform can revolutionize how your financial institution operates, enhance customer interactions, and streamline back-end processes. But the true challenge lies in choosing a platform that both your team and your customers can easily navigate and quickly adopt.

Complex features and interfaces in digital banking can sometimes overwhelm users, leading to increased support calls and slower adoption rates. This is where Whatfix steps in. Whatfix transforms the digital banking experience by integrating directly with your platform to provide seamless in-app guidance and support.

With Whatfix, your financial institution can effortlessly implement the following tailored in-app content to enhance user interaction and platform usability:

- Interactive step-by-step walkthroughs that guide users through complex banking processes.

- Custom onboarding checklists to ensure that every user feels confident from their first login.

- Contextual pop-up tips and video tutorials to assist users right when they need help.

- Automated compliance alerts to keep transactions secure and within regulatory frameworks.

- A comprehensive knowledge base that is easily searchable within the app, providing immediate answers and reducing dependency on external support.

These tools not only speed up the onboarding and adoption of new digital banking technologies, but also drive significant ROI by boosting operational efficiency and customer satisfaction. Whatfix’s analytics also empower your IT team to track adoption rates, understand user behavior, and optimize the support content continuously.

Learn more about how Whatfix can support your digital banking transformation and software adoption today.

Thank you for subscribing!